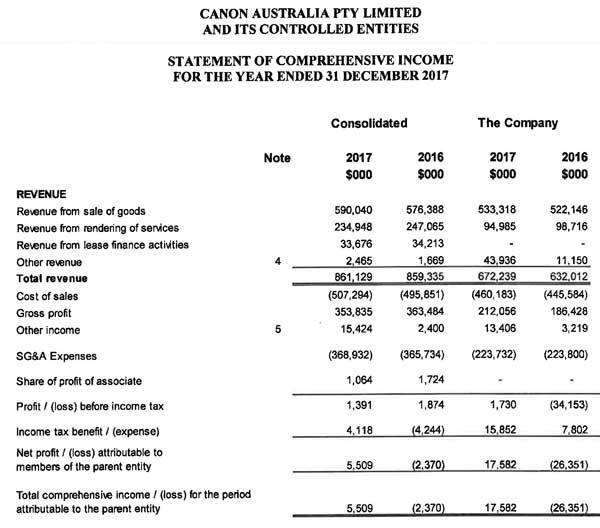

Canon Australia achieved increased sales of around $400K in its 2017 financial year, from $632 million to $672K million, but with a pre-tax profit of just $1.73 million.

This figure was boosted by $15.8 million in tax credits, with the company thus achieving a net profit after tax of $17.6 million. How amazing!

Over the past seven years (2011-2017), Canon Australia has made sales of over $4.5 billion, with total profits after tax of just over $20 million – effectively all in tax credits. During this entire seven-year period, it has paid no net tax, but instead enjoyed tax benefits from the ATO of over $35 million.

Over these years cost of sales – closely related to payments for landed cost of goods remitted to the parent company – is roughly two-thirds of total costs, with local operations making up the remaining third. As noted above, the profit component has been generally negligible – and losses accrue more tax credits!

The financial report also revealed that Canon has sold Oce-Australia Pty Ltd to Oce Holding BV at around $15 million, with the divestment taking place on January 1, 2018.

Be First to Comment