The CEO of large Australian online retailer Catch of the Day, Nati Harpaz, has nominated cameras as a category of retailing where local stores are set to gain maximum benefit from the imposition of GST on personal imports.

While offshore retailers of higher-margin consumer categories may absorb at least some of the 10 percent the GST adds to the cost of selling, that won’t be so easy in categories like photographic gear.

‘If they have the margin, like on fashion items for example, they may absorb the price, but not for smaller goods with no margin, like cameras and electronic products,’ said Mr Harpaz. ‘The prices will increase by 10 per cent unless the seller takes a hit.

‘The ones who will suffer are the guys whose whole business model was shipping you an iPhone from Hong Kong with no GST and no duty,’ he told the AFR. ‘Now that loophole has been closed, I think Australians who were shopping overseas on price rather than availability will come back to local e-tailers, and that’s a good move for the economy.’

He said that some overseas retailers may decide to simply stop selling to Australians, which will add a positive unintended consequence to the change. ‘There is an opportunity for local retailers and online players to extend their range, or import goods from overseas and sell them locally,’ he said.

He anticipated a certain level of confusion at the start, as not all overseas retailers will be aware of the changes.

‘A lot of US and Euro websites are not aware of the ruling, so won’t charge the GST,’ he said. ‘There is a good chance that the goods will be stopped at the border if the GST has not been paid.’

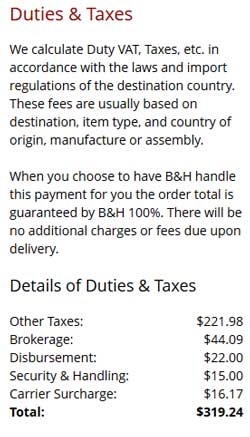

Currently, the world’s largest camera retailer, B&H, offers Australian buyers the option of having taxes and duties on products over $1000 collected via the shopping cart, or handling payment themselves, which if extended to lower value products probably won’t satisfy the ATO’s requirements.

Adorama will need even more ‘guidance’ as currently it wipes its hands of taxes and duties to international buyers altogether – with the exception of Canada, for which it does collect VAT. The question for both of these big online camera retailers might be whether the Australian market is worth implementing changes for.

But the elephant in the room is Amazon. Currently there are around 50 retailers selling on the Amazon Australia site. Some are local retailers and some are from HK or Taiwan. Then there are strange hybrid beasts like BuyMobile and Amaysim who present themselves as local businesses but ship from overseas. They don’t appear to charge GST even though they bang on about prices being inclusive of any GST/customs related fees (Just don’t ask for a tax invoice!).

Then there’s Amazon US itself offering 130 products in the Camera & Photo category. Amazon will be breaking the law if it doesn’t collect GST on behalf of its Amazon Marketplace clients and while it had a massive dummy-spit when it wasn’t able to shove the obligation to collect GST on to couriers, it appears it accepts this obligation: ‘Based on our assessment, we will redirect Australian customers from our international sites to amazon.com.au where they can shop for products sold by Amazon US on the new global store, available today,’ Amazon said in a statement at the end of May.

‘This will allow us to provide our customers with continued access to international selection and remain compliant with the law, which requires us to collect and remit GST on products sold on Amazon sites that are shipped from overseas.’

‘We’re hoping this tax fairness will give a much-needed boost to the industry and we will continue to work with the Government to ensure a 100 per cent collection rate,’ said Australian Retailers Association CEO Russell Zimmerman.

he Australian Retailers Association has said it will work with government to ensure compliance with a controversial new tax on low value imports.

International retailers will be forced to collect and remit GST on imports valued at under $1000 under the new regulation, which comes into effect next week.

ARA executive director Russell Zimmerman, who lobbied for the changes for several years, has joined a chorus of local retailers saying they are looking forward to the changes.

Proponents of the legislation believe large international retailers like Ebay and Amazon have been unfairly advantaged by not having to charge GST on many products they’re selling to local shoppers.

“We’re hoping this tax fairness will give a much-needed boost to the industry and we will continue to work with the Government to ensure a 100 per cent collection rate,” Zimmerman said on Thursday.

But amid longstanding concern from impacted retailers, including Amazon, Ebay and Alibaba, that it will be difficult to ensure high rates of compliance with the legislation, Zimmerman said the ARA would work with government to ensure a good outcome.

Zimmerman said discussions with government and the ATO would include proposing additional collection models to improve compliance.

International retailers are scrambling to ensure that they are compliant with the changes, having complained that it would be difficult to chase down the thousands of third party sellers on their networks to ensure GST was being charged.

Ebay announced it would work on a solution allowing it to collect GST from buyers purchasing in any currency, from any of its sellers.

Amazon, on the other hand, will redirect any customer within Australia to the company’s Australian online shop – effectively barring them from the more robust US store.

“While we regret any inconvenience this may cause customers, we have had to assess the workability of the legislation as a global business with multiple international sites,” Amazon said in a statement last month.

Treasurer Scott Morrison said the legislation would ensure multinational corporations paid their fair share of tax in Australia.

“If [they] aren’t forced to pay their fair share of tax, they will have a competitive advantage over retailers here in Australia, on our own main streets and in our shopping centres,” Morrison said in response to Amazon’s decision.

During consultations Ebay cited Treasury modelling that found a so called ‘vendor collection model’ would yield a tax compliance rate as low as 25 per cent.

Marketplaces last year offered an alternative model whereby Australia Post and others would have collected GST on purchases when they came into the country, but the postie said it would have been a massive burden on its operation.

KPMG, commissioned by Amazon, produced modelling that predicted compliance rates as high as 70 per cent under a logistics model.

Be First to Comment