Until next July, local retailers will be at a massive disadvantage competing against grey marketers on the Amazon Australia website.

The inequity of the GST-free loophole for overseas retailers is writ large by Amazon Australia. If Amazon is going to be the retail giant-killer some predict, any further delay in the elimination of that loophole will be devastating to sections of Australian retailing. It’s potentially a Trojan Horse for offshore retailers who until July 1 next year have a built in 10 percent price buffer over locals competing on the Amazon Marketplace.

The inequity of the GST-free loophole for overseas retailers is writ large by Amazon Australia. If Amazon is going to be the retail giant-killer some predict, any further delay in the elimination of that loophole will be devastating to sections of Australian retailing. It’s potentially a Trojan Horse for offshore retailers who until July 1 next year have a built in 10 percent price buffer over locals competing on the Amazon Marketplace.

While grey marketers have operated via Ebay for many years, the arrival of Amazon provides them with the kind of platform they haven’t enjoyed before. For the canny consumer, Ebay screams out ‘Buyer Beware!’ Amazon, not so much – it has an aura of legitimacy.

However the way Amazon has organised its website, it’s a real challenge to simply find out whether a retailer on the Amazon Marketplace is located offshore or is local. Here’s the relevant information from the front page of a product search on Ebay:

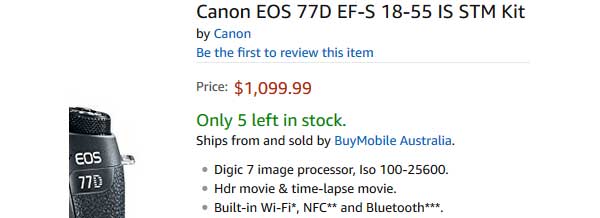

Compare the above with the paucity of retailer information on the same stage in a product search on Amazon:

A shopper has to dig deep into the fine print to discover if they are dealing with a foreign retailer. Warranty information – including whether the product is covered by a manufacturers warranty or a warranty from the seller, and whether the buyer has to pay to ship the product back to HK or somewhere – is equally buried in fine print several clicks away from where it should be.

The Amazon shopping cart process is also organised in such a way that you don’t know whether you are paying GST until after you have supplied your credit card details and made the transaction.

Amazon’s GST policy, if you can find it, is contradictory:

All prices on Amazon.com.au are shown inclusive of GST. Amazon does not separately calculate GST on items ordered from the retailer through the Amazon.com.au site. Calculation of GST is the responsibility of the retailer. Items ordered from the retailer may be subject to GST, depending on the type of product and the location to which the order is shipped. If an item is subject to GST, in accordance with Australian tax laws, the GST is generally calculated on the total selling price of each individual item, including delivery and handling charges, gift-wrap charges and other service charges, less any applicable discounts.

– So prices on Amazon are inclusive of GST, so long as the retailer fulfills its responsibility to calculate GST. Hmm…

We asked the ATO ‘whether Amazon Australia should be adding GST to products for which it is accepting payment from Australian consumers, where it provides the electronic distribution platform in Australia for overseas-based retailers: for products under $1000; for products over the low value imported goods threshold of $1000?’

The ATO asked us to put the request in writing and in 30 minutes or so later they surprised us with a response. Which was a URL to the ATO’s page on GST. We called the ATO back and pointed out we were asking a specific question not covered by the ATO website. They came back with another URL – this time dealing with changes to the GST from July next year. Our taxes at work? Anyway another email seemed to do the trick, generating the following response: Due to confidentiality provisions in the Tax Act we cannot comment on the tax affairs of individuals or entities.

However, in general terms a business is required to be registered for GST when their turnover of Australian sales exceeds $75,000.

All goods located in Australia when supplied by a business or person registered, or, required to be registered, are taxable at 10 per cent. The GST is collected by the business supplier (regardless of their residency) who then pays it to the ATO. An electronic distribution platform is not responsible for the GST on supplies of goods made through their platform if the goods are located in Australia.

– So no, an electronic distribution platform – even one with local operations – currently has no responsibility for GST collection on $1000+ goods from overseas at present. But –

Under the law changes starting from 1 July 2018 GST will apply to low value imported goods (A$1,000 or less) and electronic distribution platforms will be responsible for the GST if these sales are made through their platform. These goods will be goods located outside Australia when supplied and which are brought into Australia as a result of the sale. The GST on these goods will not be collected through border processes.

So roll on July 1! If the ATO is as good as its word, products from overseas sold by Amazon – and Ebay – will finally be offered on the same sales tax conditions as those from the local industry.

– Keith Shipton

Be First to Comment