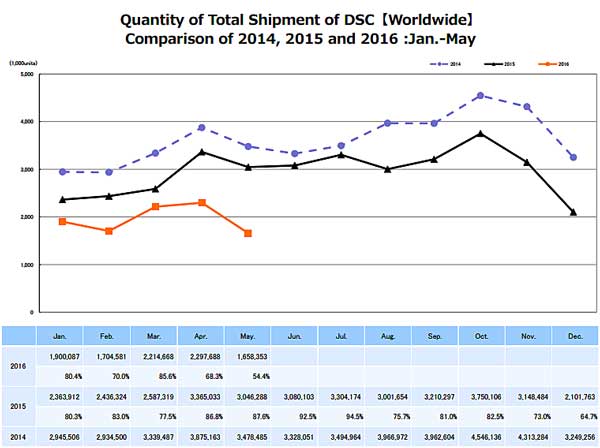

Japanese camera manufacturers association CIPA has reported an extraordinary plunge in camera production for the month of May, with shipments following suite, both falling to around half of the levels of May 2015.

Overall, digital camera production was at 51 percent and shipments at 54 percent of May 2015 levels. Interchangeable lens camera production was only slightly more pleasing, sitting at 64 percent compared to May 2015.

If the production decline was entirely demand driven, this would probably be reflected in equally worrying lens production and shipment figures. While lens shipments are down, they have ‘only’ fallen to 78 percent of May 2015 figures.

While production and shipment figures have been essentially trending down for three or four years, this is the most dramatic single monthly fall recorded. The depth of the decline is at least partially a result of the Kumamoto earthquake in March, which closed down Sony’s main digital camera sensor manufacturing plant, and other camera makers’ manufacturing facilities.

One report has the Sony sensor plant not reaching full production again until August.

Information from the Japanese camera companies is unhelpfully scant (most don’t even like to acknowledge the source of their imaging sensors), but is does appear that the reliance on Sony sensors is at the heart of the problem.

In May, Sony stated it was about to start testing its processes at Kumamoto prior to ‘sequentially’ restarting production by May 21. In the two months since then there have been no further updates. The lack of communication to customers is unusual, given the apparent reliance of a big section of the global camera industry on this plant.

Reuters (via financial website, Fortune), reporting on Sony’s 2017 financial predictions released at the end of May, stated Sony ‘partially resumed operations this month and…said wafer production would resume by the end of August.‘ (Our emphasis.)

The report further stated that the Kumamoto earthquakes alone would deliver the sensor and camera business a loss of around 105 billion yen (around $1.4 billion).

Both Sony and Nikon (which uses Sony sensors in its cameras) have formally announced delays in new camera releases. Other companies which use Sony sensors in at least some models include Olympus, Panasonic, Pentax, Leica and Canon (G series only).

In April, Nikon Corporation announced delays of up to six months in the release of new digital cameras – including the innovative DL series of premium compacts and the Keymission 360 action camera. More recently it announced the Coolpix A900 and B700 – announced in February and then delayed until July, would now not be available until October ‘due to the effects of the Kumamoto eathquakes.’ .

Sony initially put back the launch of the Sony A68 from May to August, and has now listed the following cameras as in possible short supply: a7, a7R, a7S, a5100, a77 II and a99, but also says other models ‘not specifically mentioned’ might be delayed as well.

A ‘shout out’ to photo enthusiasts on camera shortages via technology forum Whirlpool indicated that cameras using 1-inch CMOS sensors from Sony (eg, Sony RX series, Panasonic TZ110, Canon G series) have been hard to access, as well as some Micro 4/3- equipped models.

‘It appears that Sony and Nikon might have been the most severely affected in this latest earthquakes, but all companies seem to have been affected in some way,’ said Alan Small, Taree Camera House. ‘Even prior to the recent earthquakes, stocks from Japan have been patchy in many key lines, which really makes you wonder why major brands are still supporting heavy discounts on their products and using marketing schemes like cashbacks when there can be out-of-stock situations for lengthy periods.’

Sina Clayton, marketing manager with DigiDirect, confirmed supply of some popular models was irregular at best, mentioning Sony, Nikon and Olympus. She said Canon seemed to be best able to supply its full range. She indicated that Sony may have more information for its customers in the next few days.

Other photo industry executives PhotoCounter spoke to were also aware of issues with camera supply, but were unwilling to be quoted on the record.

Be First to Comment