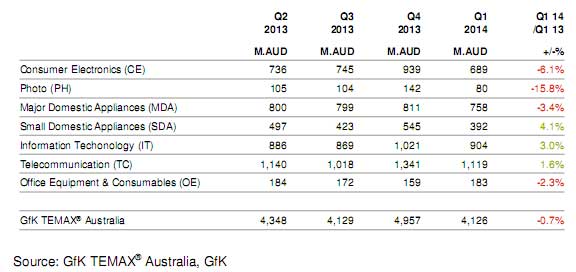

The Photo section of GfK’s quarterly TEMAX report on ‘technical consumer goods’ continues it’s downward march, falling 15 percent compared to the same period in 2013.

However, the decline masks some trends which should be good news to photo specialists. Some of the higher-margin camera categories are level or in some cases on the rise….

Overall, the Australian technical consumer goods (TCG) market levelled off in Q1, with overall revenue recording a slight decline of 0.7 percent compared to quarter 1, 2013. The market, which experienced a value decline of 2.3 percent in 2013, is showing signs of further stabilisation, as the rate of decline for Consumer Electronics continues to slow, and Information Technology returns to growth. Total retail spend, as reported by the RBA, was in growth, though consumer sentiment dropped to its lowest rate since Q4, 2012, and seems set to continue falling, given harsh budget cuts.

Min-Woo Jeong, GfK senior account manager specialising in the Photo sector, told Photo Counter that although the first quarter is always a slow one for cameras, the decline has been driven largely by the continued decline in low end digital compacts. On the other hand, ‘mirrorless interchangeable cameras are still going well,’ he said, ‘with over 40 percent growth in value over last year at this time.’

He said the mirrorless interchangeable category accounts for around 20 percent of interchangeable cameras overall. And while digital cameras overall are in decline, the interchangeable sector is simply flat.

The real bright spot is high-end, fixed lens cameras – models, such as the Sony RX100 series or the Canon G series – which offer advanced features such as full manual control and raw format shooting. ‘They actually grew by 17 percent in value,’ said Min-Woo, adding this was an outstanding result for cameras in the slow first quarter.

Long zoom models and underwater cameras have also performed well but the stand-out was this premium compact category.

The other sector which increasingly impact the photo industry is smartphones. Premium-priced phones – almost all of which have good cameras built in, continue to increase their share of the pie. The majority of phones purchased in Q1 came with a 4G connection, allowing for faster delivery of data. Photo-friendly larger screens were also more prevalent, with a quarter of all phones purchased having a 5-inch or larger screen.

When it comes to large screens, tablets were another growth area, enjoying double-digit value growth. GfK’s take on the remainder of 2014 was that it would be a flat rather than falling market: ‘The beginning of 2014 has provided reason for cautious optimism, following a further stabilisation of the consumer electronic and IT sectors. ‘However, challenges do still abound with tough macro-economic conditions, the release of an ‘austerity‘ themed federal economic budget in May, and the maturing of the previously high growth telecoms sector. ‘The market is likely to remain flat for much of the year.’

Be First to Comment