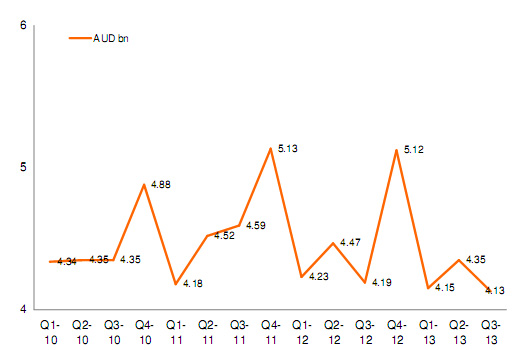

Another quarter of mixed results for what GfK describes as the Australian Technical Consumer Goods (TCG) industry, led to an overall revenue decline of 1.4 percent compared to the same quarter in 2012 according to the latest GfK Temax quarterly report.

The Photo category (cameras and printers are measured) distinguished itself once again with the poorest performance of the product categories measured with a 11.9 percent fall in dollar value compared to Q3 in 2012, and 13.7 percent when Jan-Sept 2012 is compared to the first nine months of this year. This is in fact an improvement, as Q2 2012 compared to Q2 2013 represented a decline of almost 20 percent.

The GfK figures are based on data collected by participating retailers, which includes Ted’s Cameras. While GfK data suffers from a lack of participation by JB HiFi, and it doesn’t measure online store sales, it’s the most valid publicly available.

As the GfK press release states, ‘the overall trends, however, disguise some smaller pockets of growth and opportunity’ going on to example the popularity of soundbars, which has fuelled growth within the home theatre systems sub-segment, which in turn is supporting the recovery of the audio segment.

The pockets of opportunity in the Photo hardware category are interchangeable lens cameras and accessories.

GfK analyst Min-Woo Jeong told Photo Counter separately to the Temax report that the interchangeable lens category – both DSLRS and mirrorless cameras – was at worst flat rather than declining, with a slight dip in average selling price in both DSLR and mirrorless models.

The big picture

A further quarter percent decline in Australia’s cash rate, to 2.5 percent in August, as well as a change in government in September, led to a significant increase in consumer sentiment during the quarter. This was tempered, however, by rising unemployment and consumer concerns regarding their personal financial position and security.

For the individual sectors, the industry’s increased focus on major domestic appliances (MDA) resulted in a 3.6 percent growth for this usually steady performer. Quarter 2’s surge in telecom sales dropped back to a more moderate 2.9 percent growth in quarter 3. The continuation of very mild winter weather resulted in a 1.9 percent decline for small domestic appliances (SDA), while IT, consumer electronics and photo experienced some recovery from quarter 2 levels.

Telecommunications: A raft of new smartphone model releases in quarter 2 led to a surge in value growth for the telecom sector. Relatively speaking, quarter 3 growth was modest, as consumers awaited further model releases at the tail-end of September. (See sepqarate story about Nokia’s new smartphones with advanced camera features.)

It is worthy to note, however, that quarter 3 was the first period in quite some time to report a growth in volume. Volumes of smartphones have experienced a prolonged period of decline. However, with further growth in outright purchases (ie, products that are not locked-in to a carrier) and a stabilisation of the prepaid segment, volumes have begun to bounce back.

Information Technology: The tablets segment posted its first value decline in quarter 2, despite continued, significant, volume growth. During Q3, rates of volume growth remained at similar levels, but the product mix within the segment shifted just enough to lead to a very modest return to value growth.

In the meantime, the rate of decline of mobile computers slowed dramatically, compared to Q2 results. The segment has also experienced an increase in average price since Q3 last year, due to the popularity of higher-priced, newer form factors.

Major Domestic Appliances: uly was a particularly busy month for the MDA sector. Heavy promotional activity by a couple of key brands resulted in significant volume and value growth. For a sector such as MDA, however, that can only generate a finite number of sales in any given period; peaks in transactions usually lead to corresponding slumps shortly thereafter. September sales were indeed particularly low – a trend that was further exacerbated by the disruption of the federal election.

Small Domestic Appliances: Consisting of 30+ segments, the performance of individual categories within the SDA sector varies enormously in any given quarter. During Q3, vacuum cleaners (29 percent of the sector’s revenue) experienced another quarter of solid double-digit value growth.

Shavers, food preparation, juicers and well-being also delivered significant value growth. At the other end of the spectrum, however, electric and nonelectric heating, electric blankets, hot beverage makers and kettles all experienced decline. Clearly, the mild winter weather was a significant factor, therefore, in the sector’s overall decline of 1.4 percent.

Consumer Electronics: There has been a marked slowdown in value decline for the TV segment, which still accounts for over 60 percent of the consumer electronics‘ sector value. Volume declines remain in double digits, but due to an overall increase in average price, the year-on-year value trend for TVs is beginning to flatten out.

The continued move towards larger screen sizes has been the main driver of the average price increases.

The final quarter

Another boost in the value of smartphones, the continued recovery of the consumer electronics sector, and the popularity of tablets and small domestic appliance segments on the run-up to Christmas should lead to a relatively stable performance for the TCG industry in the final quarter.

Overall, full-year 2013 results are likely to reflect the trend to-date; that is, a year-on-year value decline of 1 to 2 percent.

Be First to Comment