At a meeting in Canberra yesterday, the state and federal treasurers put off making a decision on the rate at which the LVT will apply, but appear to have agreed to reduce the threshold from $1000.

They have agreed to make a final decision in March.

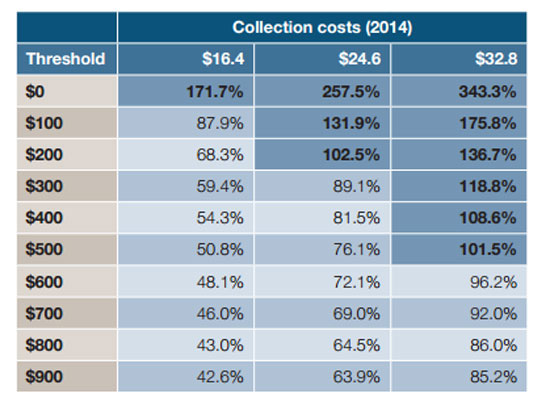

According to a report in the Financial Review, the treasurers were presented with four options, one of which was to phase in a lower LVT, starting with a $500 rate.

State treasurers were keen to move directly to a lower level, according to the Fin Review, avoiding high collection costs by having it collected at point of sale. Though this wouldn’t be welcomed by international e-tailers and shippers, it would be most efficient (as a related transaction is taking place already), and reflect the Australian system for collecting GST via retailers.

One option which is beginning to take shape is a two-tier system, with retailers encouraged to co-operate in collecting the GST at time of purchase. Goods purchased from participating companies would be delivered direct to customers, while goods purchased from non-participating retailers would need to be warehoused, inspected and processed, adding extra cost and delays for the customer.

With GST collection at point of sale, the cost per item could be as low as $4.50, according to the National Retailers Association (NRA).

A report by Ernst & Young for the NRA said that after start-up costs for the government of around $100 million, extra GST revenue could amount to $1 billion, with ongoing government costs at around $30 million per year.

Having been a speciality retailer for the past 42 years I have witnessed many rotes by unethical practises. Tax is require to run a country but to find a system that all agree with is difficult to say the least. Since the GST there has been less opportunity to rote the system than with the old sales tax regimen where many found ways around the tax system.

Having an unfair system that allows competition from traders who are not obliged by law to supply in an ethical manner [ goods return policy and faulty or unsuitable goods etc. ] Makes for an unhealthy environment. Australian public need to be reminded that by law they enjoy two weeks public holiday paid, 4 weeks annual paid leave, 4 weeks sick leave paid, long service leave and their work environment must comply with rigorous health and safety regulations, all this is not the case with external retailers so yes they are cheaper but at what cost and where do the purchaser stand when it goes wrong?

Also to whom do they complain when their item goes missing in the post? the list is huge as to what can go awry so is the list of the folk that have a happy experience but only GOD will help them if they want their item serviced or even repaired as the manufactures now track by serial number where they dispatch their product and only supply parts for their own imports. Imported goods often must be returned to point of purchase to be serviced or repaired.

Yes it is more expensive to buy in the country that you live in, work in and that is a fact.

Do we want a shambles as the USA has or do we protect our commercial environment?

It is more expensive to live in Australia but we enjoy a happier life style.

hope my piece is taken into consideration cheers to all Ron Frank

Perth