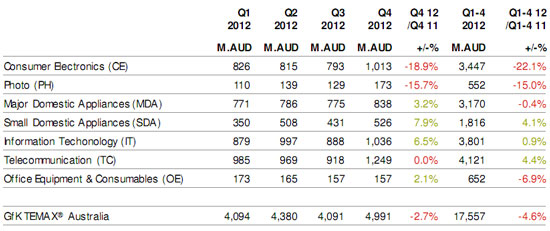

The decline in the dollar value of the Photo sector for 2012, driven largely by a 30 percent slump in sales of compact cameras, amounted to 15 percent in 2012, the same percentage decline experienced from 2010 to 2011, according to the quarterly GfK Temax report.

In the broader Technical Consumer Goods (TCG) market, the year ended relatively well, with the rate of decline returning to a more modest 3 percent during the crucial Christmas quarter, bouncing back from 11 percent for Quarter 3.

Overall, compared to 2011, the consumer technology retail industry declined by 5 percent in 2012, or $854 million in actual revenue.

The two big contributors to the decline were the ‘Consumer Electronics’ sector (GfK’s term for TVs and other home entertainment equipment) which slipped in value terms by 22 percent, following by the Photo sector (cameras, printers, etc) with a 15 percent decline.

Major Domestic Appliances remained flat while other sectors experienced small increases in sales.: IT (1 percent); Small Domestic Appliances (4 percent); and Telecommunications (4 percent). However, this contrasts with double-digit growth in IT and Telecommunications in 2011.

Office Equipment and Consummables slipped by 6.9 percent.

The 15 decline in the Photo sector follows a 15 percent decline from 2010 to 2011. It also correlates exactly with CIPA’s figures on worldwide camera shipment declines in 2012.

The Photo sector’s decline in sales when the final quarter of 2011 is compared to 2012 was 15.7 percent.

However, a closer look at the GfK figures for the Photo sector tell a more nuanced story. Compact cameras fell by a massive 30 percent, dragging down the rest of the camera category. GfK says that DSLRs remained flat, while mirrorless interchangeables grew by 70 percent – but from a 2011 level of around 3 percent of overall camera sales.

GfK’s assertion that DSLR sales were at 2011 levels could be challenged on the basis that more DSLRs are sold by photo specialist stores, and (regrettably), online offshore websites, and GfK doesn’t have a the same level of sales data from the specialist channel as it does from CE and mass market retailers; and doesn’t measure online sales at all.

Another positive GfK’s photo sector analyst has shared with Photo Counter readers is that average selling price declines have been arrested. Though local ASP’s didn’t rise in 2012 (as in global shipments as reported by CIPA at the CP+ conference in Yokohama last month), they remained steady, arresting the decline in ASPs for the two previous years.

GfK’s analyst told Photo Counter that the decline in sales was predominantly in the low-end compact market, with pockets of growth in higher-end segments such as superzooms and wide-angle compacts. He said that the new group of large-sensor compacts – represented by products such as the Sony RX100 and the Canon GX1 – was still very much a niche market.

Small Domestic Appliances: The only sector to deliver consistent quarter-on-quarter growth throughout 2012, peaking in quarter 4 at 8 percent. Dental care and hairstylers registered the highest growth rates for the quarter (40 percent).

Telecommunications: GfK says that the entire consumer technology retail industry is increasingly dependent on the performance of the Telecommunications sector – or more specifically, on the mobile phone segment. After the meteoric rise of smart phones in 2011, sales value levelled abruptly in quarter 2 and remained flat for the remainder of 2012. The flat value disguised the double-digit volume decline experienced by the sector in the final couple of quarters. Fortunately, during this period, a slate of new model releases in the premium smart phone segment resulted in a 6 percent increase in average price. By the final quarter, over 40 percent of all smart phones sold held an average price of $750+.

Major Domestic Appliances: Value and volume sales remaining flat on 2011.

Information Technology: Following a slump in sales in quarter 3, the IT sector experienced a strong uplift in quarter 4, with sales value up 7 percent on last year. The month of December was the first period in which unit sales of tablets more than doubled those of notebooks, and tablet value was also greater than notebooks for the first time. Fortunately, the uptake of media tablets was so strong on the lead-up to Christmas, that the revenue generated from this lower-priced segment outweighed the revenue declines in notebook and desktop computing.

Consumer Electronics: Despite experiencing the largest year-on-year declines for the full-year period (22 percent), the final quarter saw the first slow-down in the rate of value

decline for the Consumer Electronics (CE) sector for some time (from -28 percent

in quarter 3, to -19 percent in quarter 4).

Headphones continues to be the one single segment within the CE sector that is enjoying unit and value growth. The value of this segment is now equal to the entire audio home system segment.

‘Throughout 2012,’ GfK concluded, ‘the TCG market was characterised by aggressive price discounting and an increased pressure on new model releases and technological innovation to drive sales. Traditional retail channels were under significant pressure, and a fundamental re-structure of the Australian retail scene was evident, as the industry began to adapt to new market conditions.

‘While it is encouraging that the focus within TVs has returned to value generation, rather than the drive for unit share, the maturing of the IT and Telecom sectors will present the greatest challenges for the year ahead.

‘In the meantime, the market will turn to the Domestic Appliances sectors to continue to provide underlying stability during a period of change and uncertainty.’

Be First to Comment