According to the latest BIS Shrapnel report on the retail property sector, Retail Property Market Forecasts and Strategies 2012 to 2022, ‘specialty shop occupancy costs are…unsustainably high for some tenants.’

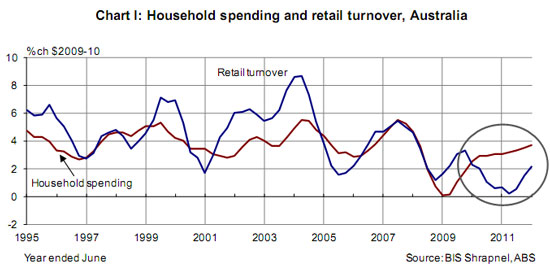

BIS Shrapnel forecasts that growth over the next five years will average just 2.9 per cent per annum, compared to the mid-1990s to the GFC, which saw turnover growth of almost five per cent per annum on average in real terms.

‘There should be some improvement following very subdued rates of turnover growth in the last few years,’ says report author Maria Lee, senior project manager at BIS Shrapnel. ‘However, while we expect turnover growth to strengthen through 2012/13 and 2013/14 in line with a strengthening Australian economy, growth will remain fairly subdued in the medium to long term.’

The BIS Shrapnel study also looks at the implications for shopping centre lease costs.

”Shopping centres will see markedly lower rates of turnover growth thanks largely to the growth of online shopping and the dilutionary effect of additional retail floorspace,’ said Ms Lee.

The report shows that online retailing is now a force to be reckoned with.

‘Our online retailing survey showed a dramatic rise this year in the online offerings of the top 20 domestic retailers,’ said Ms Lee. ‘Over 50 per cent of the top 20 now have a comprehensive online offer. Although that’s a great improvement, it‟s still not impressive by international standards. The department and discount department stores are still trailing — although they are working on major improvements.’

Price matching a major factor

‘Consumers are using price comparison websites or apps on their mobile phones when in-store, and then demanding a price-match in order for them to buy there and then,’ said Ms Lee. ‘This can have an impact on retailer profit margins.’

Another aspect of online retailing, one which has had a profound impact on photo retailing, is purchases from overseas websites. This expenditure isn’t counted within BIS Shrapnel’s local ‘retail turnover’ figures, but the growth of online spending overseas helps explain why consumer spending in total – including overseas online spending – is growing at a solid pace but retail turnover growth is subdued.

A further factor is retail spending that takes place in-store by Australians when they are overseas on holiday – which is happening more and more. Both of these factors are likely to continue to be a drain on retail turnover growth as long as the Australian dollar stays high.

Excess floor space

Construction of new retail floorspace continues to outpace both population growth and real retail turnover growth. This has been a long term trend in Australia, broken only during the late 1990s/early 2000s period of unusually strong turnover growth.

‘It‟s surprising that this is happening now, when floorspace growth is relatively muted due to the challenges facing development in the post-GFC environment,’ said Ms Lee. ‘It means that, in real terms, turnover per square metre is falling.’

Even though turnover growth is weak, shopping centre incomes are supported by the fact that the majority of tenants pay fixed annual rental escalations of around four per cent.

‘The problem is that if rent is going up by four per cent a year but turnover is growing by less than that, occupancy costs rise. Specialty shop occupancy costs are at an all-time high. They are unsustainably high for some tenants.’

Those costs are leading occupants to either not renew at the end of the lease or demand a cut in rent to stay. If they leave, the incoming tenant is achieving a more attractive offer, in a combination of lower rent and/or leasing incentives.

‘There’s widespread evidence of slowing centre income growth as a result,’ said Ms Lee.

The dominance of fixed annual escalations means that centre income growth will fluctuate within a fairly narrow band of around two to five per cent per annum. But Ms Lee warns that shopping centre income growth could be weaker if the Australian dollar falls.

Prospective returns for regional shopping centres are between nine and 10 per cent over a five-year and 10-year investment horizon, according to the report.

Businesses don’t plan to fail – THEY JUST SIMPLY FAIL TO PLAN.

WORK “ON” YOUR BUSINESS AS WELL AS “IN” YOUR BUSINESS.