The Interim Report of the Low Value Parcel Processing Taskforce reveals that low value (under $1000) parcels from overseas have grown 36 percent over the last two years, and over 20 percent between 2010 and 2011.

While the Interim Report gives little hint of what it might ultimately recommend when it hands down its final report in July, the Taskforce has consulted widely with stakeholders, including retailer groups representing the bicycle, music and general retail sectors.

Facts & figures

Between the financial years 2006/7 to 2010/11, the number of parcels being delivered through Australia’s international mail gateways has grown from 23.56 million to 48.06 million – an increase of 104 per cent.

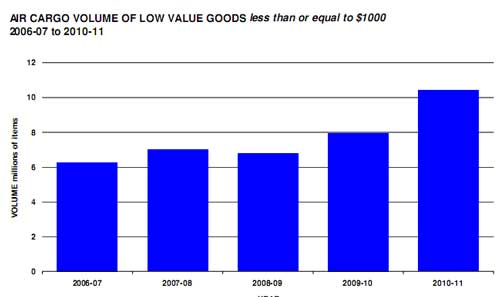

The bulk of the increase in parcels has been packets of less than 2kg, which represents 80.1 per cent of the increased volume. Over the same period, the volume of parcels valued between $0 and $1000 passing through international air cargo operators has increased from approximately 6.3 million to 10.4 million.

The National Retailers Association (the lobby group for big retailers such as Woolworths and Coles) estimates an annual increase in online sales – both local and international – ranging from 7.6 per cent to 20.4 per cent per annum.

‘While recognising that these projections relate variously to domestic and international online sales growth, and may also include products such as ticket deliveries, simply assuming an annual parcel growth in line with the mid-point of these estimates (14 per cent per annum), would mean that over the next four years Australia would see an increase in mail parcels passing through the international gateways to around 81 million by 2014/15,’ the Report stated.

Over $1000 imports falling? (Not!)

While all the other data provided in the Interim Report points to a rapidly growing online offshore channel in Australian rretailing, it’s interesting to note that in 2010-11, the Report states that around 39,000 postal items were processed for duty and/or GST liability, of which a little under half – 17,318 – were goods declared to have a value over $1000, with the remainder related to alcohol and/or tobacco products. This is a drop from the previous, GFC-impacted year, when approximately 43,000 items were processed for duty and/or GST liability, of which 19,056 were valued at over $1000.

It’s even more interesting to note that the report seems to take these discordant figures at face value, not questioning the level of false declaration of value.

Australia out of kilter

Perhaps the most compelling argument for a reduction in the threshold is a chart in the report which shows Australia is massively out of kilter with other free market economies is the application of a low value threshold (Australian dollar equivalents):

Australia: $1000

NZ: $312 (not collected unless GST revenues amount to over $60)

Korea: $300

Singapore: $300

UK: $23

Canada: $20

US: $0 (no national sales tax – $200 for import duty, $100 for gifts)

Japan: $0

The final report will be presented to the Assistant Treasurer, the Hon David Bradbury, in July 2012. It will contain ‘a comprehensive blueprint for reform, with costed alternatives and timeframes for implementation.’

Unfortunately these cost alternatives will not include a firm recommendation on a revised low value threshold as: ‘It is not within the Taskforce’s Terms of Reference to specifically recommend the application of any particular threshold level.’

It’s clear, however, that any changes will have to be at best cost-neutral. Equity for local retailers takes a second place to this criterion, as laid down in the earlier Productivity Commission report:

There are strong in-principle grounds for the low value threshold (LVT) exemption for GST and duty on imported goods to be lowered significantly, to promote tax neutrality with domestic sales. However, the Government should not proceed to lower the LVT unless it can be demonstrated that it is cost-effective to do so. The cost of raising the additional revenue should be at least broadly comparable to the cost of raising other taxes, and ideally the efficiency gains from reducing the non-neutrality should outweigh the additional costs of revenue collection.

The Taskforce has travelled to Canada, the UK and Singapore to get a better understanding of how these countries are able to work the miracle of collecting GST on imported goods without sending their governments broke!

Judging by the lack of anything in this Interim Report approaching recommendations or even costings to implement alternatives, the Taskforce has a huge amount of work to do between now and July.

To view the report, click here.

Be First to Comment