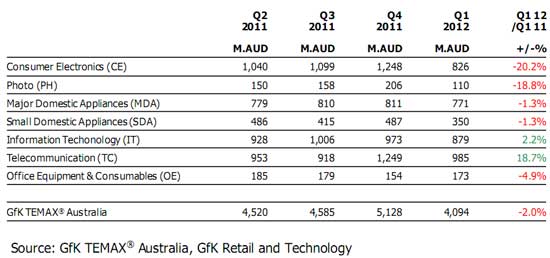

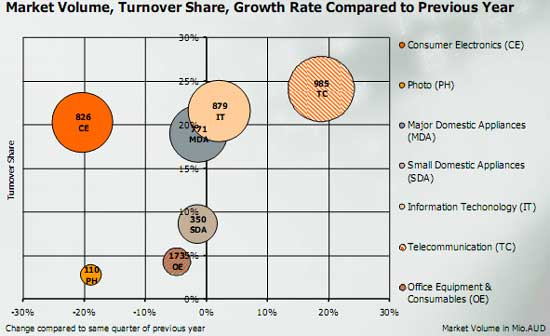

The latest GfK TEMAX report, on the Technical Consumer Goods (TCG) market in Q1, 2012, identifies a dramatic 19 percent drop in the value of the Photo segment.

GfK bases these figures on input from a panel of ‘bricks and mortar’ retailers, and doesn’t measure domestic or offshore online sales. The Photo category as measured by GfK includes cameras, camcorders and printers, and excludes all accessories and printing services.

The far larger Consumer Electronics segment (TVs, audiovisual, DVD players, etc) has been hit even harder, declining just over 20 percent. But in the face of challenging conditions, GfK says the 2 percent year-on-year value decline experienced overall by the Technical Consumer Goods (TCG) market in the Q1, 2012 quarter ‘was something of a triumph’.

A tough local and global economic climate, soft consumer confidence and a strong Australian dollar also resulted in spend being lured away from the local market.

GfK identifies the Telecommunications (+19 percent) and IT (+2) sectors as almost offseting the value declines in the market.

The 19 percent decline in the value of the Photo sector (Q1 2011 Vs Q1 2012) is seen in a somewhat positive light by GfK, as it was less than the 23 percent experienced in the final quarter of 2011 compared to Q4, 2010 (‘the outlook has improved slightly’).

On to other categories, GfK further noted that minor levels of price erosion across the Major Domestic Appliances sector resulted in revenue decline of 1.3 percent for the quarter, while the unseasonably cool summer did no favours for the Small Domestic Appliances sector, also dropping just over 1 percent in revenue.

Photo sector

Compact system cameras continued their strong volume growth with 30 percent more selling this quarter than in Q1, 2011. In spite of continued volume growth of DSLR models, compact system camera volume share of the changeable lens segment grew to 15 percent (up from 12 percent in Q1 2011).

This performance was helped by more players and more models, with 9 brands actively selling 34 models of compact system cameras during the quarter compared to just 6 brands selling 18 models during the same period last year.

Within the fixed lens camera segment – the hardest hit in the Photo sector in recent times – some positive movements can also be found. Fixed lens cameras with zoom capability of greater than 15x have grown by 36 percent in volume.

While this growth is offset by falling sales in other segments of the compact market, with their higher average price, these high-zoom cameras now represent 23 percent of all value generated by the fixed lens camera market (up from just 9 percent in Q1, 2011).

Telecommunications

With smartphones now out-selling mobile phones at a rate of 3 to 1, it appears that consumers have been upgrading from one smartphone to another, fuelling the continued growth of the segment. Despite strong double-digit growth, however, the segment is beginning to show signs of maturity, with the rate of growth slowing significantly since Q4, 2011.

With 180 smartphones available on the market, consumers of this segment now have more choice than ever. New models released during the quarter were in-line with the recent trend towards larger screens and slim form factors, and Android remained the dominant operating system, accounting for over half of the models sold.

The inclusion of new technologies – such as Near Field Communication (NFC) – at the top-end of the smartphone market may help fuel future growth within the segment. Despite the current lack of infrastructure in Australia, NFC capability has increased from less than 1 percent of smartphone sales in Q1, 2011, to 6 percent in Q1, 2012.

While on the one hand bolstering the strong performance of the IT sector, the popularity of webooks, with an average price some 30 percent below that of notebooks, is also contributing to the slowing value growth of the sector.

Webbooks enjoyed a great run in the first quarter of 2012, out-selling note-books in monthly volume for the first time in March, on the back of the iPad 3 launch.

With the sector’s growth sitting at just 2.2 percent, interestingly, Q1, 2012 saw an increase of over $100 in the average selling price of notebooks when compared to Q1, 2011. The proliferation of the new ultrabook form factor – a slimline, fully-featured notebook – is one reason for the average price increase. Continuing supply issues for hard-drive manufacturers, resulting from last year’s Thailand floods, also contributed. This effect can also be seen in the external hard drive segment, with average prices increasing by 29 percent in the quarter.

Be First to Comment