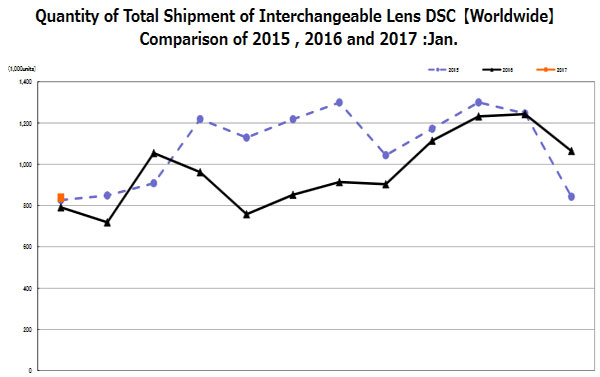

A close reading of the latest CIPA camera production and shipment figures indicates that the supply line disruption due to the Kumamoto earthquake is over, and that all growth in the camera market is now in the mirrorless interchangeables category.

Two thousand and seventeen is shaping up as the year mirrorless interchangeables become the powerhouse of the photographic industry.

Quite simply, mirrorless is the only category which shows any growth. While shipments of DSLRs are at 89 percent of January 2016 levels, shipments of mirrorless interchageables are at 148 percent of January 2016 levels.

The dollar value of DSLRs has held up well (up 6.5 percent on Jan 2016) given the decline in units, indicating higher end DSLRs are in demand. The dollar value of mirrorless interchangeables is around line-ball with volumes – average selling prices have been fairly static.

The CIPA figures also indicate the free-fall in the digital compact market might just be coming to an end, with shipments at 93 percent of January 2016 levels, and 106.7 percent in dollar terms – once again indicating higher priced models are in demand. By comparison, only 72 percent as many digital compacts shipped in January 2016 as in January 2015.

If consumers are now looking more favourably on lightweight, more compact mirrorless cameras, this poses a challenge for Canon and Nijkon, neither of which have made a strong impression in the mirrorless category to date.

Shipments of lenses were around level with January 2016 levels, with growth coming from the sub full frame category – APS-C, Micro Four Thirds, etc.

Be First to Comment