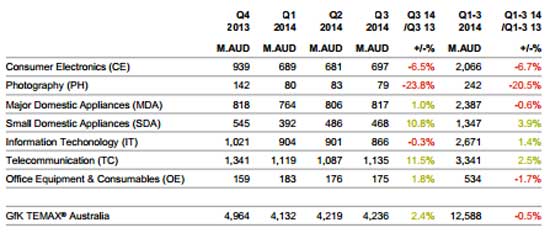

After three years of what’s coyly described by business writers as ‘negative growth’, the quarterly GfK Temax report on the Australian Technical Consumer Goods (TCG) market recorded ‘positive growth’ of 2.4 percent in revenue terms this quarter – although the Photography category continues to decline.

‘Photography’ – in which GfK measures camera and printer sales – has fallen 20 percent in revenue terms when the first three quarters of 2013 are compared with the year to end of September, 2014. The fall from Q3 2013 to Q3 2014 was 24 percent.

However, GfK analyst Min-Woo Jeong told Photo Counter that there were bright spots in camera sales, with the mirrorless interchangeable or CSC segment growing by around 23 percent compared to Q3 in 2013. DSLR sales were ‘fairly soft’ in the quarter and so overall, interchangeable lens camera sales were slightly down. (It’s worth noting that there were no real blockbuster new camera releases in the quarter – nor the previous quarter.)

The other standout segment was ‘superzoom’ compact cameras, which GfK defines as cameras with a zoom range of 21x or greater, which also showed marked growth.

And of course stellar growth in the increasingly photo-capable smartphone segment can no longer be divorced from the photo industry, even if the channel isn’t selling those devices. The current ‘Burning Question’ readers poll in Photo Counter sees 56 percent of participating readers claiming that one quarter or more of their photo printing is now from smartphones.

Overview

Growth was led by double-digit increases in key sectors Telecommunications (smartphones) and Small Domestic Appliances.

Telecommunications: Telecoms sector recorded significant double-digit growth in Q3, led by new model launches within the quarter. The new phone releases have also come at a higher price, helping drive value growth in the market. Smartphone prices have risen by over $100 since Q3, 2013.

A key trend to note in smartphones is the move towards bigger screens. In Q3, the value generated by phones with a screen size of 4.5-inches or larger rose by 67 percent on last year and accounted for nearly two thirds of all smartphone value. (And with bigger screens comes a greater focus on picture-taking.)

Small Domestic Appliances: Vacuum cleaners – the largest of the small appliance segments – were one of the main drivers of value growth. On-the-go personal blenders and blenders with cooking functions were also particularly popular.

Major Domestic Appliances: After consecutive quarters of moderate decline, major appliances grew 1 percent in value during Q3, despite a decline in volumes.

Information Technology: The value of the IT sector remained relatively flat in the latest quarter. While most individual segments performed positively, a sudden slowdown in the sales of tablets resulted in a decline of the overall sector. Value decline of tablets was particularly steep – reaching double-digits – with the decline in volume exacerbated by a move to smaller screens and a softening of average prices. In contrast, the recovery in sales for mobile computing accelerated this quarter. The largest of the IT segments, this was the first quarter of value growth for mobile computing since 2011.

Consumer Electronics: The home entertainment sector declined by 6 percent in value. For TVs, the demand for super-large screens continues to drive the value recovery of the segment. Three quarters of all TV revenue in the quarter came from TVs sized 47-inches and above. The move towards bigger screens and higher specifications has led to an overall price increase of 7 percent. An important feature is UHD/4K which, at its premium prices, has helped add value into the market and now accounts for nearly a fifth of the TV market’s value. High-end segment growth has also impacted positively on the audio systems segment, where Network Music (or ‘multi-room’) systems account for nearly a fifth of the market value, as manufacturers and retailers continue to increase their focus on wireless technology. Within this category alone, models that dock or stream wirelessly account for nearly 80 percent of the value of the segment.

Christmas outlook

The steep value increase in the telecoms sector is expected to continue into the Christmas quarter, and should offset declines in revenue elsewhere.

However, the performance of the tablet market will be a key factor in whether the market as a whole finishes the year in growth.

Be First to Comment