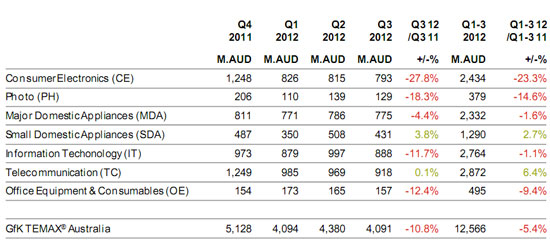

Revenue from third quarter sales of cameras, printers and camcorders is off by almost one dollar in five (18.3 percent) compared to the third quarter of 2011, according to the quarterly GfK Temax index.

For the full year from January to September, sales are down 14.6 percent. Camera sales represent the vast bulk of the ‘Photo’ dollars measured in the Temax report, and the result masks a more complex story, with sales of low-end compacts plunging, while overall revenue has been propped up somewhat by more pleasing unit sales of higher value, higher margin DSLRs and mirrorless interchangeables.

GfK has told Photo Counter that (admittedly from a very low base), mirrorless interchangeable lens cameras have doubles in sales value, while DSLR sales have also held up, and in fact recorded year-on-year growth of three percent comparing Q3 2011 to Q3 2012.

However, it needs to be noted that GfK does not measure online sales – so that any channel swapping away from bricks and mortar to online, particularly from CE channels, where GfK has strong retailer involvement, will have exaggerated the fall in sales.

Photo was the second worst performer in the Temax index after the much larger Consumer Electronics (TV, AV, etc) segment, which experienced a 27.8 percent decline from Q3 2011 to Q3 2012. Overall, spending across what GfK calls ‘Technical Consumer Goods’ is down 11 percent for the period and over 5 percent for the calendar year to the end of September.

Small Domestic Appliances continued to perform against the trend, with a value growth of 4 percent. Star segments within this sector continue to be food preparation products, hot beverage makers and vacuum cleaners, while hair stylers generated the quarter’s highest value growth.

Growth in the smartphone-fuelled growth Telecommunications sector came to an abrupt end, with value remaining flat.

The IT (personal computer) sector also reported an unprecedented double-digit decline. Strong growth of new technology segments (media tablets and touch-screen PCs) continues to be significant, but is not sufficient to compensate for overall declines in average price. This declining average price is a result of both general price erosion, and more significantly, by the changing structure of the sector: unit sales of media tablets exceeded sales of notebook PCs for the first time in Q3.

GfK concluded by stating: ‘The Australian TCG market is clearly experiencing some exceptional challenges, causing significant turmoil within the retailer base. The quarter has been marked by store closures and changes in ownership, while the industry re-structures and re-positions itself for the uncertain future ahead.

‘Overall trends are unlikely to change significantly during the lead-up to Christmas, but new model launches and product developments will be optimised, in order to maximise the peak season’s share of consumer spend.’

To access the GfK Temax press release in PDF form, click here.

COMMENT: A plunge in sales of the scale currently being experienced in the compact camera category in photo retailing could never be seen as a welcome development. However, there are a few factors which make the near 20 percent drop in sales revenue not the disaster it could be. The first is the sterling performance of DSLRs, which are both of higher dollar value and higher margin than your average compact camera. So the 20 percent drop in revenue doesn’t mean an equivalent drop in profit, so long as you are selling your share of higher-end gear. (And then there are accessories, of course.) The second is that the area of greatest innovation in the camera market – mirrorless interchangeables – is now attracting the interest of Australian customers. A doubling of sales from Q3 2011 to Q4 2012 would augur well for Q4 2012!

The third is that although sales of ‘me-too’ type compacts have stalled dramatically, sales of smartphones with adequate cameras are through the roof. So provided the industry can inveigle the population to do a bit more with their digital files (‘We print from smartphones’, etc) all that’s been lost is the pathetic margin on the sale of the compact, and perhaps a $20 camera pouch.

And it may be that, with the mass market apparently bored with digital compacts, some of the the mass merchants and big CE stores will quickly follow suit. (And don’t forget JB having to make room for all those bloody fridges!) Even if they don’t, there are already less outlets selling photo goods, with store closures over the past 12 months: Clive Peeters no longer, Dick Smith in a state of flux, WOW out of action, Retravision in trouble, and Harvey Norman not the powerhouse it once was. This reduction in the number of outlets competing in photo retailing won’t hurt the photo specialist nor the remaining CE stores.

Be First to Comment