The Australian Retailers Association (ARA) and the NSW State Treausurer have welcomed the Low Value Parcel Processing Taskforce’s final report as a blueprint towards achieving a level playing field for online, traditional and multichannel Australian retailers alike.

Following the release of the report, the political ground has shifted slightly in favour of lowering the threshold, following the contribution to the debate from NSW Treasurer, Mike Baird.

Mr Baird wants the Commonwealth to look at cutting the threshold from $1000 to about $30, offering the propspect of an abolition of stamp duty on house purchases as a poissible sweetener.

Until his intercession, a lower LVT was a ‘political orphan’ beyond the support of small businesses’ only champion in Federal Parliament. independent senator Nick Xenophon.

”It’s clear that the GST base is growing less than anticipated and the government needs to look at all options to replace revenue that is essential to deliver services and the building of infrastructure,” said Mr Biard in an SMH article (7/9).’

‘It’s time that we seriously consider online retailing because it is growing exponentially and means that our domestic retailers aren’t competing on a level playing field.’

The commission report estimated that about 2 per cent of all retail sales, worth about $4.2 billion annually, were from overseas online retailers, with about 77 per cent of those worth less than $100.

ARA executive director Russell Zimmerman said the report highlighted the need to address and remove the inherent disadvantage the LVIT currently presented to Australian retailers as well as open up a desperately needed revenue stream for state and territory governments.

The Taskforce’s report has identified Australia as the odd man out, with most countries moving to lower their thresholds to $0, and many already sitting under $100.

In Britain, VAT is payable on most online purchases worth more than £18 ($28). In Canada the threshold is $C20 ($19) and in the US it is $US200 ($187).

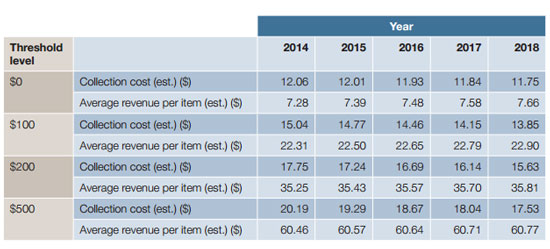

The report’s recommendations show how the GST threshold could be lowered to an acceptable level as collection methods improve over the next few years. This will require investment in customs and border control measures, which the reports own figures show will be recovered within a year or two.

‘As the beneficiaries of additional revenue from these proposed changes as well as the ones who pay for implementation costs, ARA is calling on state and territory governments to support the investment required (which ranges from $25 million to $40 million) to achieve up to $272 million in revenue by 2014.

‘The report shows the debate has extended far beyond any perceived battle between online and bricks and mortar retailing and proves that a staged, incremental move towards reducing the threshold will ensure retailers in Australia- online, bricks and mortar and multichannel- are subjected to the same trading conditions as overseas retailers.

‘The ARA welcomes the report’s recommendation to address parcel processing inefficiencies with better border protection and collection processes, which will help close the current revenue trapdoor causing state governments to miss out on millions of dollars in valuable income.

‘The additional state revenue will translate to community benefit – think employment of police, teachers and nurses. It also means putting Australian retailers and Australian online retailers on an equal GST footing with the rest of the global retail market to create jobs, pay taxes and contribute to local wealth creation.

‘The report is a well-presented and researched plan to implement competitive tax neutrality for low value imports. The Government and Taskforce should be congratulated on such a comprehensive suite of recommendations.

‘ARA sees this set of recommendations as a clear path to reducing the cost of low value GST collection which will allow the lowering of the GST low value threshold.’

For a copy of the Low Value Parcel Processing Taskforce final report, click here.

NOTE: While the report above, and notions of fair play and community argue for a lowering of the GST threshold, it will take a lot more to persuade Australian citizens that there’s anything in it for them. A poll conducted by the SMH after the story referred to here had only 15 percent of around 10,000 respondents supporting any kind of reduction in the threshold.

I am so sick of the retail industry making itself look like a pack of whingers to the public.

Why on earth does the retail industry continually push such an unpopular line that the government can safely ignore, knowing the public doesn’t want to see a lowering of the threshold on GST exemption for imports.

Surely a much better arguement would be to push for a GST exemption for all retail purchases in Australia that are under the existing import threshold.

Now that would be popular with the public and how are the government going to argue that buying goods that keep the local economy going and promote local employment should be penalised with GST, however sending the money (and jobs) overseas is a preferred action.

If we agressively pushed the line “The government wants to penalise you for being a true Australian! Demand the same GST exemptions for Australian purchases and keep Australia strong.”

we might see some real action on this issue instead of “studies” and “reports”.

You are so right.

I’ve made a video about this, check it out:-

http://www.youtube.com/watch?v=gASv-zrnMy8&list=HL1350916793&feature=mh_lolz